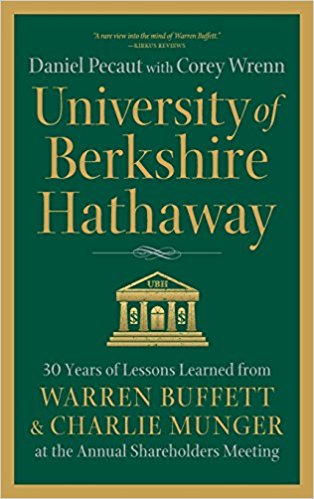

Warren Buffett Quotes

Years ago I created a collection of my favorite Quotes from Warren. I think investors like him and Charlie Munger are great aggregators of wisdom because it’s a requisite of long-term investing in my opinion. And with investing I don’t just mean money, time is the most important investment we all make, whether we do … Read more